When it comes to comprehensive betting companies, Blackstone vs BlackRock are two of the best names in the industry Although their names sound similar, their business models, methods and the types of speculative vehicles they offer are very distinct.

In this article, we’ll delve deeper into the Blackstone vs BlackRock discussion, clarifying the key contrasts between these two budget mammoths, their core operations, and which speculative choices might be superior for different types of investors.

What is Blackstone?

Blackstone is one of the largest private speculation firms in the world. Founded in 1985 by Stephen Schwarzman and Dwindle Peterson, it initially began as a mergers and acquisitions advisory firm but long ago expanded into private equity. Today, Blackstone is best known for its focus on electoral initiatives. This implies that the firm contributes to areas that are outside of conventional stocks and bonds.

Center area of Blackstone

- Private Value: Blackstone is best known for its private value trading. This includes buying shares in private companies, making a difference in the development of those companies, and offering them for a profit, inevitably at that time.

- Real Will: Genuine Will is another core focus of Blackstone. The company has developed critical speculation in commercial real domains worldwide, counting office buildings, inns and warehouses.

- Hedge Stores: Blackstone also oversees hedge stores that calculate both price and liability strategies, focusing on different strategies to maximize returns.

- Credit: In an extension of personal value, Blackstone is a major player in the credit space, offering companies credit and other credit items.

Blackstone’s approach is exceptionally hands-on. The firm effectively oversees its projections, frequently reengineering or advancing the companies it contributes to. This approach aims to generate higher returns, yet with higher risk

What is BlackRock?

On the other hand, BlackRock is the world’s largest asset management firm. Founded in 1988 by Larry Fink and a group of associates, BlackRock’s center is much more diverse and includes both traditional and cutting-edge enterprise vehicles. Unlike Blackstone, which leans heavily toward selective estimates, BlackRock’s essential focus is on providing estimates to regulatory clients, financial advisors, and individual investors.

Center area of Blackrock

- Asset Management: BlackRock’s central business asset management. The firm oversees venture portfolios for clients ranging from individual speculators to large institutional clients such as annuity stores, endowments, and sovereign wealth funds.

- ETFs (Exchange-Traded Stores): One of BlackRock’s best-known offerings is its iShares ETFs. These are speculative reserves that allow financial experts to buy a wide range of assets such as stocks, bonds or commodities in a single venture product.

- Mutual Reserves: BlackRock also offers a wide range of shared reserves for both individuals and regulatory financial specialists. These stores are actively or passively supervised, the latter being more cost-efficient for investors.

- Fixed Pay: BlackRock invests in fixed income securities, such as bonds, that pay speculators and help adjust opportunities within an extended portfolio.

BlackRock has a reputation for advertising broad, low-cost systems to speculators. The firm focuses primarily on advertising liquid, freely exchanged assets.

Blackstone vs BlackRock: Key Differences

1. Speculation Technique and Focus

When comparing Blackstone vs BlackRock, the most essential contrast is their estimation technique.

- Blackstone: Specialist in Elective Speculation. This includes saving private values, actual domains, and support. These types of ventures are routinely illiquid, meaning they are difficult to offer or obtain in the short term. Blackstone’s initiatives are generally focused on achieving long-term horizons, through operational enhancements and restructuring.

- BlackRock: Mainly focuses on open-end ventures, calculation stocks, bonds and ETFs. BlackRock’s strategy is more expansive, entering global markets with both dynamic and passive estimation methods. BlackRock is known for creating venture items open to everyone, counting small investors.

Thus, Blackstone vs BlackRock reflects the distinct approaches each firm takes in overseeing venture portfolios: one focused on hands-on, high-risk speculation (Blackstone), while the other focused on liquid, differentiated open markets (BlackRock).

2. Target Clients

Another key difference in Blackstone vs BlackRock discussions is the type of clients each firm serves.

- Blackstone: Mainly targets regulated speculators, high-net-worth individuals and certified financial experts. Blackstone’s speculative vehicles require a higher minimum valuation, making them less available to the general retail investor.

- BlackRock: While BlackRock also serves regulation clients, its items are more available to retail financial specialists. Through the proliferation of shared reserves and ETFs, BlackRock is able to cater to individual speculators looking to construct diversified portfolios with varying levels of risk.

3. Measurement and scale

In terms of valuation, BlackRock is the big company.

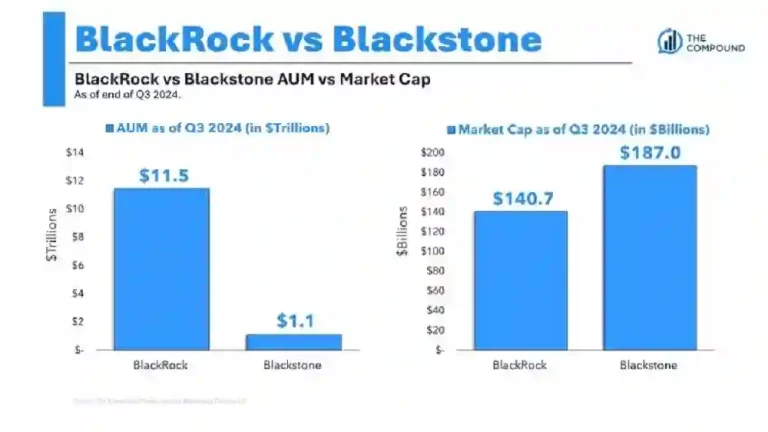

- Blackstone: As of 2024, Blackstone oversees $1 trillion in assets. Although this is a significant sum, it is still less than BlackRock.

- BlackRock: With more than $10 trillion in assets under administration, BlackRock holds the title as the world’s largest asset management firm. Its huge scale allows it to offer a wide range of speculative items to clients worldwide.

This contrast in measure within Blackstone vs BlackRock has implications for the types of initiative openings each firm can offer. BlackRock’s global reach and sheer speculation give it the ability to offer more broadly accessible, liquid venture items, while Blackstone’s specialized focus on discretionary speculation allows it to seek out higher-return opportunities.

4. Open versus private investment

A major refinement of the Blackstone vs BlackRock comparison is the different types of estimates for each firm.

- Blackstone: The center is largely on personal speculation. Blackstone buys into private companies, regularly moving those companies through management changes or other interventions. These ventures tend to be illiquid in nature and more liquid, meaning that financial specialists at Blackstone’s Reserves will not be able to exit their positions quickly.

- BlackRock: Bargain fundamentally with open assumptions. BlackRock offers market exposure through items such as general stores, ETFs and record reserves. These ventures tend to be more liquid, allowing financial specialists to purchase or offer assets quickly.

This makes Blackstone vs BlackRock particularly relevant to financial professionals who are looking for individual levels of liquidity and can display different types. If you’re looking for a venture that’s easy to trade, BlackRock is probably a better choice, while Blackstone’s private ventures can offer those looking for high-risk, long-term opportunities.

5. Opportunity and return profile

- Blackstone: Because of its focus on private value and elective speculation, Blackstone routinely accepts higher risk in trades for higher potential returns. Speculations in private equity, real estate, or fence shops can be volatile and fluid, meaning financial experts must be prepared to take on higher risks for the opportunity for more significant returns.

- BlackRock: While BlackRock offers more high-risk venture items, it is for the most part focused on advertising more stable, broad choices for speculators. Its ETFs and shared reserves are designed to provide steady, long-term returns with less leverage than the high-risk nature of many of Blackstone’s investments.

So, Blackstone vs BlackRock is a key consideration in terms of hazard and return. Financial experts who lean toward soundness and low risk may drift toward BlackRock’s offerings, while those seeking higher returns and willing to accept more opportunities may find Blackstone’s venture items more appealing.

6. Liquidity

Liquidity is another area where the two firms contrast significantly.

- Blackstone: Blackstone’s ventures are liquid for the most part. Private value enterprises, in case, can be tied for a long time for some time recently they are sold or left. Actual will estimates can also take time to offer and regularly involve critical measures and due diligence.

- BlackRock: BlackRock’s ETFs, shared reserves and other freely exchangeable items are deeply liquid. Financial experts can buy and offer offers in open advertisements at any time between trading hours

Therefore, if you respect liquidity in your venture, the Blackstone vs BlackRock choice will be clearer. BlackRock offers more liquid ventures, whereas Blackstone’s speculative vehicles may require longer time commitments.

7. Item Type

- Blackstone: Offers items such as Private Value Reserves, Support Reserves and Genuine Will Speculation Trusts (REITs). These items are usually directed towards more experienced financial experts who have a high risk tolerance and can handle the longer time frames involved in these investments.

- BlackRock: Offers a broad cluster of freely accessible items, listing stores, ETFs, general stores and fixed income securities. These items are open to most financial professionals, counting those who lean toward passive or low-cost venture strategies.

8. Costs and Expenses

- Blackstone: Due to the more complex nature of its estimates, Blackstone’s costs may be higher. These costs routinely include administrative costs, executory costs, and other costs associated with overseeing personal value reserves and real estate investments.

- BlackRock: After all, BlackRock’s items are known for their low costs, especially for discrete venture methods like file reserves and ETFs. This cost-effective option is attractive to individual speculators looking to reduce fees.

Investing Experience: Which is Right for You?

The choice between Blackstone vs BlackRock usually depends on your forecasting objectives, opportunity resistance and the type of financial expert you are.

If you need longer returns and can handle more risk

If you’re a licensed financial professional and you’re looking for higher returns, Blackstone could be a great fit. Their private value, real domain, and fence support methods offer significant return potential, but they come with higher risk and longer time horizons. These ventures are for the most part less liquid, so if you can handle that, Blackstone may suit your goals.

If you need liquidity and diversification

If you are looking for more liquidity and greater growth, then BlackRock may be the right choice. BlackRock’s ETFs and general stores offer financial experts access to global markets with a wide range of resource classes. Furthermore, the firm’s items are highly liquid, allowing you to make changes to your portfolio as needed.

For fledglings or isolated investors

If you’re starting out with equity contributions or prefer a more hands-off approach, BlackRock’s List Stores and ETFs are a terrific choice. These items are affordable, easy to obtain, and allow you to track advertising metrics.

Conclusion

The Blackstone vs BlackRock comparison highlights critical contrasts in terms of venture approach, risk profile, liquidity and client base. Blackstone is best suited to those looking for higher returns through individual value and variant speculation, while BlackRock offers a more open, discrete, and liquid speculation phase for individual and institutional investors.

Each firm serves a variety of financial specialists, and the right choice for you will depend on your financial objectives, opportunity exposure, and forecast horizon. Understanding the contrast between Blackstone vs BlackRock will help you make better-informed choices as you move forward with your estimation journey.